Business Value Protection

Funding buy sell agreements with life insurance

If you own Business Jointly with your Partner?

What happens if a Co-Owner passes away?

How to Set a Business Value Protection Trust?

Important points to remember while creating business trusts.

"I need to find an exit for my shares when I am not around".

A well-constructed plan is essential to protect the value of the business and provide cash for the family in the event there is a major disruption in the business due to a co-owner’s death, disability, retirement or serious major illness or any other event that jeopardizes the continuity of the business.

As a Business Owner Owning a Business Jointly with your Partner (Co-Owner) Ask yourself: -

- If a co-owner dies today, can you work with his family to run the business?

- Will the co-owner’s family members know how to run the business with you?

- Can they work well with you?

- Would your beneficiaries be able to get a fair price if they wanted to sell the shares?

- Do you have the funds to buy out the deceased co-owner’s shares/interests from the family members when there is no pre-agreed price in a written agreement?

- Can the shares/interests you are purchasing be transferred quickly to you?

Problems without Business Protection Plan

Often these are: -

- A new partnership is created due to the inheritance of the shares/interest by inexperienced heirs. Chances are this new partnership may fail.

- There is no pre-agreed price for any sale to take place when the heirs decide to sell to the other co-owners. As a result, it may take years to settle a transaction price.

- Some of the unqualified heirs may insist on being directors of the company and be active in running the business. This may lead to serious disruptions and disputes within management.

- It is possible that the co-owners may decide to abandon the business and start their own due to disputes with the heirs.

- Where inexperienced heirs get involved in the business, there tends to be loss of profits and uncertainty about the business future success.

The Solution –Business Value Protection Trust

Our Business Value Protection Trust ensures a smooth transition of the business to the other co-owner(s) and the value of your share of the business is protected against an event such as: -

- Death

- Incapacity

- Ill health

- Retirement

- Disappearance for an agreed period

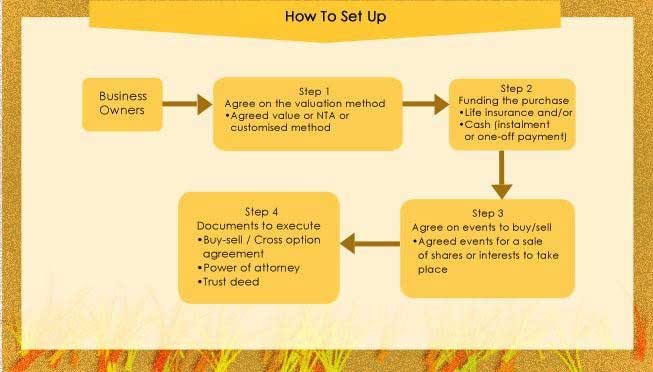

How to Set a Business Value Protection Trust?

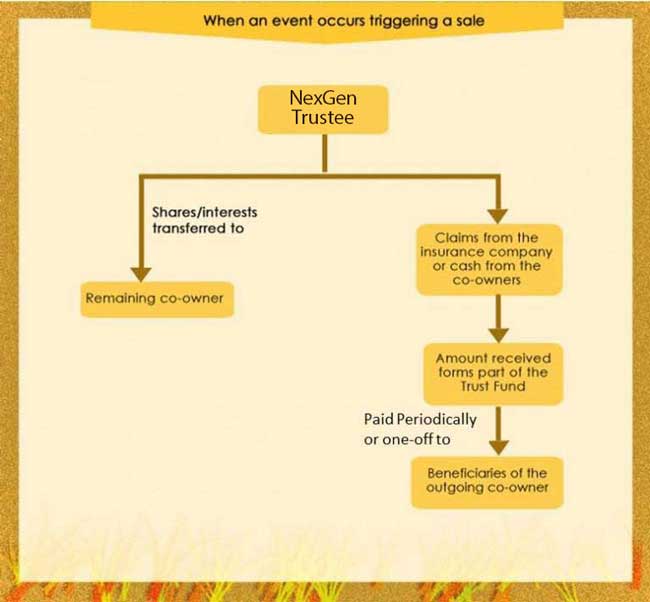

When an event occurs triggering the sale?

When an event occurs triggering the sale?

The Business Value Protection Trust Consists of:

The Business Value Protection Trust Consists of:

- A Buy-Sell or Cross Option Agreement: covering the terms of the sale and purchase including the agreed value or formula, events triggering a sale, funding and mode of payment.

- Power to the Trustee, to transfer the shares/interests to the other co-owner(s) upon the occurrence of the agreed events that trigger a sale.

- Trust Deed by the co-owners: instructions to Trustee regarding the periodical distribution of the sale proceeds to prevent these being misspent by the beneficiaries.

- Life insurance policy: as the main funding mechanism to purchase the shares/interest of the outgoing co-owner.

The main reason why "Business protection trusts" or "Business trusts" are used is to enable business owners (partners, members of LLPs or shareholding directors in limited companies) to effectively provide for business succession whereby in the event of the death (or serious illness ) of one of the owners, the surviving or continuing owners can purchase the business interest of the deceased or seriously ill owner so that they retain control of the business while the family of the deceased owner (or the ill owner himself) is fully financially compensated.

Typically, any such arrangement will involve a life assurance policy on the life of each owner written in a business trust and an option agreement for sale/purchase. Both parts of the arrangement are equally important if the objective is to be achieved. The option agreement will ensure that the purchase takes place and the life policy in trust will provide the funds necessary to achieve it.

A typical scenario referred to above is a business owned and run by its owners. There will be, of course, non-typical scenarios, some more common than others. For example, one common situation is where the spouses/civil partners of the working owners also own some shares in the business but are not involved in the day-to-day running of it. As such the spouses would not be involved in any share purchase but their shares would normally be sold/bought at the same time as the shares owned by the working spouses. We can draft trust deeds for this type of case as well.

Then there will be cases where the ownership structure is a little more complex, perhaps involving a corporate owner, i.e. where one of the shareholders is a limited company. In such cases the "standard" draft will not be suitable but that does not mean that a share purchase plan cannot be put in place.

Important points to remember while creating business trusts:

It is important that everyone contributes an amount to the overall cost of the premiums under the policies that reflects the benefits that may be received under the trusts. If there is a large disparity in premium payments in respect of the individual owners' policies, a form of premium "equalization" may be necessary to ensure that no element of gifting is involved. In effect, each owner should pay a proportion of the total cost of the arrangement that is commensurate with the likely benefit they may receive.

Also consider the Tax Implications of the Premium Contributions as well as the Claim received on passing away of one of the Co-Owners.

Business trusts may be a specialist subject but certainly need not be over-complicated as long as they are drafted properly.

We at Nexgen Estate Planning Solutions Private Limited can create Business Value Protection Trusts as per your unique requirements.

Contact your Nexgen Estate Planner to know how we can help you plan, create and maintain a Business Value Protection Trust.

and we'll contact you for our "

Business Value Protection

".