Writing a Will in India

Why should you make a Will?

CAN I WRITE MY OWN WILL ?

Without a valid Will.

COMPARISON OF A TRUST AND A WILL

Comparision of a Will & Trust

What is a Will?

A Will is a legal document you draw up to declare your wishes for your loved ones as to how you want your assets to be distributed after you passed on.

WHY DO I NEED A Will?

Without a Will, your assets could give more troubles than benefit to your family at a time when they are most vulnerable. Your loved ones could be involved in a long drawn legal process or fighting in a complex legal battle with other family members.

Without a Will, the law will decide who your beneficiaries, trustees and guardian would be. There is a legal process to go through before your loved ones can benefit from your assets. Leave nothing to chance. Make a Will and the law will protect your wishes.

You should never assume that your assets would automatically go to the person you want to benefit. Give them security by making a Will and the law will protect your wishes.

WITHOUT A VALID WILL

Firstly, the deceased’s assets are frozen. His/her family, spouse and children might face cash flow problems while waiting for the grant of “Letter of Administration”.

Even after the “Letter of Administration” all your assets will be distributed per the Succession Act applicable to you.

If you die intestate (i.e. without a valid will) you lose the right to appoint executor, trustee and guardian of your choice. Your children’s welfare may not be taken care of by the right person.

As Letters of Administration (LA) is required, application to the Court requires:

- More time require to fulfill the requirements for the application of LA than if the will was present.

- More legal costs are involved.

- If both the husband and wife decease together, the court will appoint guardian for the minor children.

- Family contention may arise. Family members may be fighting in the court over the distribution or choice of assets.

- Letter of Administration can be granted after 14 clear days from the date of death of an intestate.

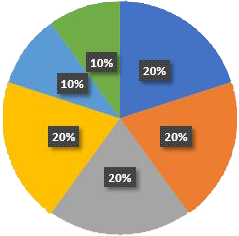

- Your Spouse may not be absolute owner of your assets it would be divided between Your Children, Your Mother and Spouse (In case of Hindu Male).

- Under the Hindu Succession Act if Mother of the deceased is alive She get equal share as Wife and Children. Problems arise as after Mothers death these assets are passed on to her legal heirs.

- This complicates the distribution as there are more claimants.

AND, WITH A VALID WILL

- You provide for your beneficiaries in the way you choose rather than letting the laws decides.

- You exercise your RIGHT under the law to appoint people of your choice to administer your estate and carry out your wishes, ensure and safeguard the interest of those you loved and care. You select your preferred executor whom is expected to do a good job when you pass on.

- You can also provide support in monetary form or in kind to other selected family members e.g. stay-in partner, aging uncles, dependents, friends, step-children, temple or any charity organizations etc. All these persons have no provisions under the law.

- You appoint Trustees and Guardian of your choice for your infant children in the event of your spouse predeceasing you or if both of you were to pass on. These are trustworthy persons who will ensure your children’s welfare are in good hands.

- Generally, it costs less in term of legal fees and less time to apply for a Grant of Probate (GP) than Letter of Administration (LA).

- Family members who depend on you can avoid facing financial hardship.

Conflict & problems faced over the appointment of administrator (s)

- Family conflict arises over the right to be appointed as the Administrator(s).

- There is risk of the Administrator(s) misappropriating the estate.

- Appointed Administrator(s) may lack competence to perform.

- Family might not be able to obtain the 100% consent from all legal beneficiaries required.

- When there is a minor beneficiary, administration of the property may be awarded to Court of Wards

Legal Fees higher to apply for LA

- To apply for LA, the family members might receive less due to the generally higher legal costs incurred.

Financial difficulties faced by the family as it takes more time to apply for LA

- Normally it takes 1 to 2 years OR MORE, thus dependents may face cash flow problems as the deceased’s bank accounts are frozen.

- Succession under the Law might result in a change in ownership in businesses/companies of the deceased which might lead to fragmentation and loss in continuity and control.

The Law takes over your ‘RIGHT’ to name your legal heirs

- As there is no Will, whom your legal heirs are and their proportion for distribution are decided by the law.

- The distribution may not be that of your choice, and you lose your Right to distribute your hard-earned assets the way you want it.

- Under the Law, there is no provisions for partner, stepchildren, illegitimate children, father, relatives whom you support.

The Law takes over your ‘RIGHT’ to appoint custodian and guardian for your minor children.

- If both parents die in a common disaster, the Court decides who are the trustees & guardians for your minor children.

- The appointed person(s) might not be competent to perform the job.

- Welfare of minor might not be taken care of.

- Misuse of funds by the appointed Trustee might happen.

- You lose your Right to choose your preferred trustees/guardian.

WHY IT IS IMPORTANT TO HAVE A Will?

A PERSON DIES WITH A WILL

- You provide for your loved ones in the Will i.e. you choose your heirs rather than letting the law to decide for you.

- You Father, Live in Partner, Step Children, Illegitimate Children, Aged Relative, Adopted Child (If you are a Christian) or others who depend upon you can be provided for in a Will.

- You exercise the right to appoint people of your choice to administer your estate (Executor) and to carry out your wishes, safe guarding the interest of those you love and care.

- No family conflict could arise over the choice of administrator(s)/executors.

- You can appoint guardian of your choice for your infant children, so that their welfare, support, health and education will be taken care by the right person.

- Generally, it costs less in term of legal fees to apply for Grant of Probate (GP) than Letter of Administration (LA).

- With a Will, the whole legal estate administration process is expedited.

- Your loved ones are financially protected.

A PERSON DIES WITHOUT A WILL

- Your estate will be distributed to your legal heirs as per Succession Acts i.e. Hindu Succession Act if you are a Hindu, Sharia if you are a Muslim & Indian Succession Act if you belong to any other Religion.

- Under the law, there is no provision for these group of people. They might fall into financial difficulties without your support.

- The Court decides for you. It might not be your choice.

- Family conflict may arise on the choice of administrator(s)/executors.

- The Court decides for you. It might not be your choice or the best person for your children.

- Legal fees could be costly.

- Without a Will the legal process could take years. Assets could have shrunk in value when Letter of Administration is obtained.

- Your family could be facing serious financial difficulties.

DO YOU KNOW?

Do you know?

Nominee is not the owner of the funds on most of the Financial Assets rather he or she is merely a Caretaker of the Funds and must distribute these funds to the legal heirs of the deceased.

Do you know?

There is an estimated Rs.64000 crore worth unclaimed accounts in banks, insurance companies, post offices, provident fund accounts left by people who passed away without passing information of these funds to their legal heirs. If people start writing “Wills” this can be avoided.

Have you ever wondered?

That if both parents were to go together, who will step into the parent’s position to take care of the children’s education and welfare? Who will be able to keep the child with him or her i.e. Who will get the Custody of the Child?

You may not know...

That without a Will, your loved ones might have to wait for years; running around to find out and claim your assets. You lose your RIGHT to appoint the executor of your choice to administer your estate & your preferred custodian/guardian for your minor children.

You ought to know...

That without a Will, your assets will be distributed in accordance to the “Succession Acts” applicable to you. Under the Act, your assets will be divided between your surviving spouse, children and parent(s)/mother in a certain proportion. More problems arise if your parent(s)/mother passes away after you. Your assets may be subdivided further between your brothers and sisters etc. Result? There will be many more additional claimants!

Have you ever wondered?

What will happen to your loved ones / dependents if they are unable to receive your assets in the shortest possible time after your demise?

You may think...

That you do not have much to give away. The truth is writing a Will has little to do with your net worth but everything to do with leaving a legacy of love and care.

You must Consider that.

90% of your assets are without nominations & 99% of eligible Indians do not have a Will? Thus, there is an urgent need for you to write a Will. If not, the law will decide who will be your heirs / trustee / guardian, NOT YOU! Assets may become FROZEN AND UNCLAIMED under the Law. Why leave it to the law when you can decide in a Will?

When Should You Consider Getting a Will?

90% of your assets are without nominations & 99% of eligible Indians do not have a Will? Thus, there is an urgent need for you to write a Will. If not, the law will decide who will be your heirs / trustee / guardian, NOT YOU! Assets may become FROZEN AND UNCLAIMED under the Law. Why leave it to the law when you can decide in a Will?

When Should You Consider Getting a Will?

MARRIAGE

MARRIAGE

RELATIONSHIP BREAKDOWN

RELATIONSHIP BREAKDOWN

NEW BORN

NEW BORN

TRAVELLING

TRAVELLING

CHARITABLE DONATION

CHARITABLE DONATION

ACQUIRE NEW ASSETS

ACQUIRE NEW ASSETS

WHO ARE NAMED IN A WILL? THEIR ROLES...

|

Person

|

Who is HE/SHE?

|

HIS/HER Role

|

|

Testator

|

A person who writes a Will

|

|

|

Executor(s)

|

Person(s) or Trust Corporation appointed by the testator to administer his/her estate.

|

- To locate the Will

- To make funeral arrangement

- Apply for Grant of Probate (GP)

- Calling in assets of deceased

- To pay debts

- To prepare Statement of Accounts

- To distribute assets according to the Will

- To carry out wishes mentioned in the will

|

|

Trustee(s)

|

Person(s) or Trust Corporation appointed in a Trust Deed.

|

To hold on trust for beneficiaries who will get assets in a Trust.

|

|

Guardian

|

A person appointed in a Will to take custody of minor children.

|

To take care of the welfare of minor children and their assets.

|

|

Beneficiary/Legatee/Heirs

|

A person or corporation named in a Will.

|

To receive assets of the Testator.

|

|

Two Witness

|

A person who witness the signing of Will by the Testator.

|

To confirm that the testator signed the Will in front of them.

|

CAN I WRITE MY OWN WILL OR DO A 'DIY' WILL?

It is always not advisable to write our own wills because we might not achieve what we want and avoid what we don’t want. The following might happen:

- Partial intestacy - No residuary clause

- Easily subject to contest in court, may cause future problem

- May not be granted a Probate - Vague

- Not fully aware of certain legal implication

- May not take care of your worries

- No assurance/protection to beneficiaries e.g. no trust fund to protect family members

- No appointment of guardian for minor children

- May not help to realize your goals!

Remember, a Will must ‘function’, when you are not there. It is said a Will speaks from Grave.

It may cause delay, problems, frustrations, anger, hardships to our family and loved ones when it is not properly drafted and 100% valid under the Law.

Get a Professional to write, even it is a simple one as it grants you with Peace of Mind & Makes Our Wishes Come True.

WHAT IS A TESTAMENTARY TRUST?

A testamentary trust (sometimes referred to as a will trust or trust under will) is a trust specified in a Will a person’s Will which arises upon the death of the testator. A will may contain more than one testamentary trust, and may address all or any portion of the estate.

A testamentary trust goes into effect upon an individual's death and is commonly used when someone wants to leave assets to a beneficiary, but doesn't want the beneficiary to receive those assets until a specified time. Testamentary trusts are irrevocable.

What is a testamentary trust?

is a trust contained in a last will and testament that provides for the distribution of all or part of an estate and often proceeds from a life insurance policy held on the person establishing the trust. There may be more than one testamentary trust per will.

Who are testamentary trusts created for?

Generally, testamentary trusts are created for young children, relatives with disabilities, or others who may inherit a large sum of money that enters the estate upon the testator's death.

How is a testamentary trust created?

A testamentary trust is provided for in a last will by the Testator, who appoints a “trustee” to manage the funds in the testamentary trust during the trust period until the “beneficiary,” or person receiving the money, takes over the assets as per the trust deed so created.

When is, a testamentary trust created?

The trust kicks in at the completion of the probate process after the death of the person who has created it for the benefit of his or her children or others; note this differs from “inter vivos” trusts, which are created during the lifetime of the settlor.

How long does a testamentary trust last?

A testamentary trust lasts until it expires, which is provided for in its terms. Typical expiration dates may be when the beneficiary turns 18 years old, graduates from university, or gets married.

Who can be the trustee of a testamentary trust?

The person creating the trust may choose anyone, but it should be someone the person trusts to act in the best interests of the children or others receiving the trust funds. If, for any reason, the person chosen declines to take on the responsibility of trustee, you can name your second choice, someone else can also volunteer or the court will appoint a trustee.

WHO NEEDS A WILL?

- All Indians – Married or Single

- Foreigners who owns assets in India

- Expatriate working in India who owns assets in India

Why use NexGen Comprehensive Will-writing Service?

As you accumulate more assets and are busy building your career, a NexGen Estate Planner can take your instructions in the privacy of your office or the comfort of your home. Using our unique Comprehensive Will-Writing system and personalized service, your Will can be tailor made to suit every situation.

- Comprehensive and Professional Will-Writing Service

- Fulltime in-house legal advisors to support and check all Wills

- Professional Custody Service for keeping all Wills securely

- Special Trustee Service to complement your Will to ensure extra protection for your beneficiaries

- Continuous personalized service, fully backed by the No.1 Comprehensive Will-Writing Company in India

- Personal Assets Inventory Booklet to help you organize and track your assets and liabilities